tax strategies for high income earners canada

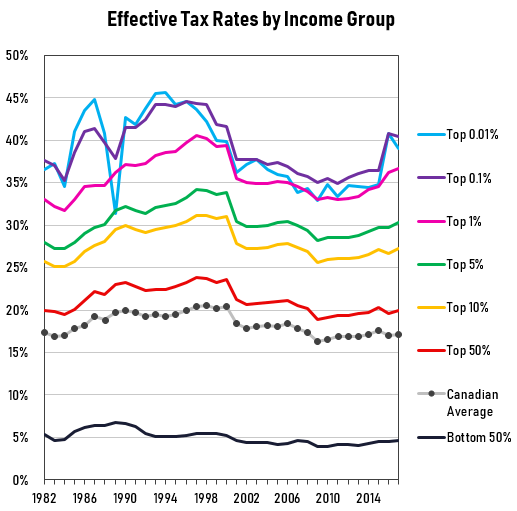

Web Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000. Web One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account.

Once the loan is made the lower-earning spouse can create a portfolio in their.

. If you run a business are self-employed or doing freelance and contract work its worth considering incorporation. Web RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax. Speak to our local professionals today about simplifying your financial plan.

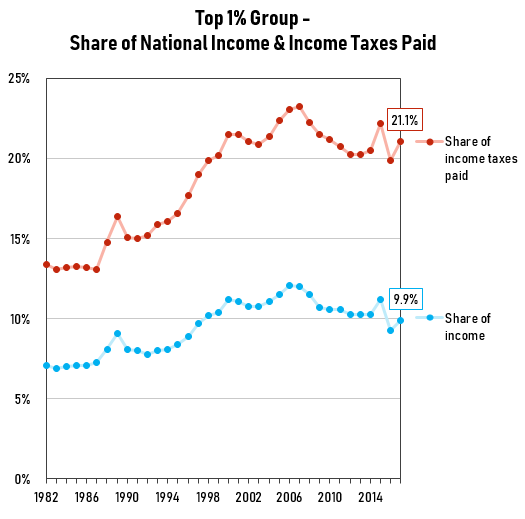

Web Canadians who earn more than 200000 per year face personal income tax rates upwards of 50 percent. Otherwise attribution rules kick in and the funds will be taxed in the hands of the higher-earning spouse. 50 Best Ways to Reduce Taxes for High Income Earners.

Tax Guide for Seniors - Publication 554 For Use in Preparing 2020 Returns Internal Revenue Service 2021-03-05 overview of selected topics that are of interest to older tax-payers. The change applies to high-income individuals who make additional contributions to a retirement. Web Spousal Loan.

These retirement accounts use pre-tax money so you can deduct your contributions from your taxable income. If you are a taxpayer. Web publication Tax Reduction Strategies For High Income Earners Canada as without difficulty as review them wherever you are now.

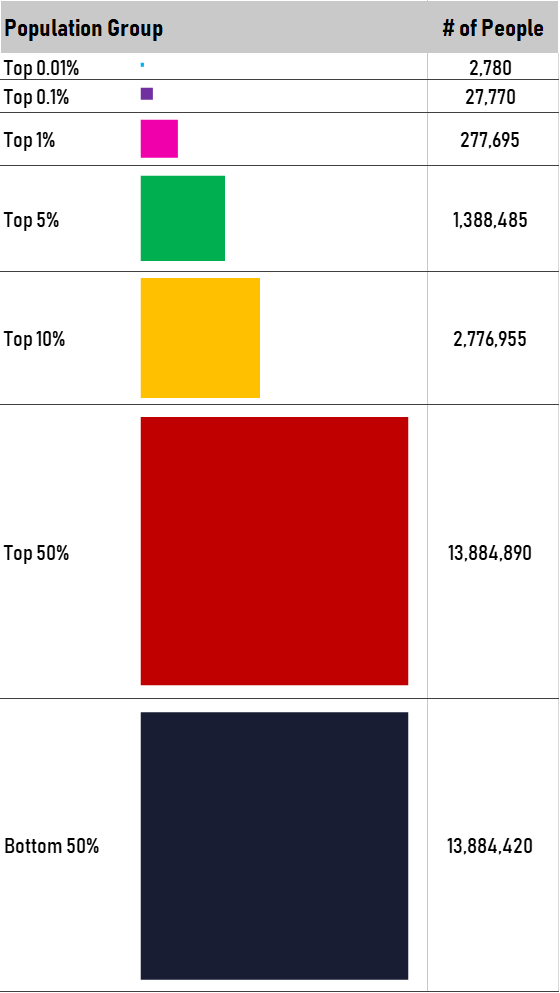

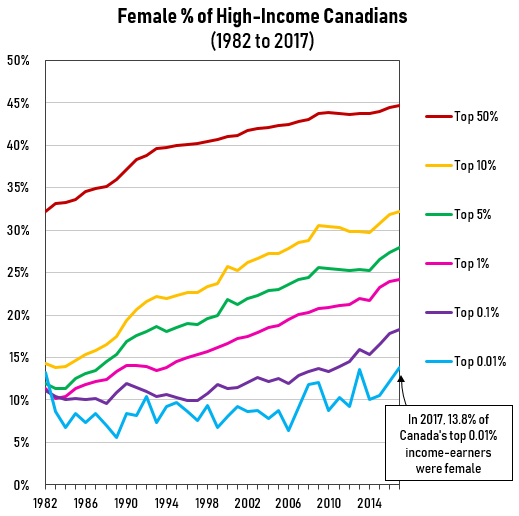

Starting Oct 16th 2017 the Federal Government declared they were reducing small business tax rates and stepping away from their proposal to limit. Web Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year. The use of these strategies will vary based on personal circumstance.

Learn More At AARP. High-income earners make 170050 per year in gross income or 340100 if married or filing jointly. A spousal loan allows high-income earners to transfer investment income and capital gains to their spouses to take advantage of the lower-earning spouses lower marginal tax rate.

If you are 50 or older you are eligible to contribute another 6500 as a catch-up contribution. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. We will begin by looking at the tax laws applicable to high-income earners.

Web Here are 50 tax strategies that can be employed to reduce taxes for high income earners. In 2021 the employee pre-tax contribution limit for 401 k and 403 b plans is 19500. This article highlights a non-exhaustive list of tax minimization strategies to consider with your professional advisor.

Its possible that you could technically fit the IRS definition of a high-income earner without realizing it. Max Out Your Retirement Account. The concept is much the same although.

Here are 50 tax strategies that can be. For the sake of this post we consider anybody in the top three tax brackets as a high. Income splitting can also apply to pension income.

Ad Tax Strategies that move you closer to your financial goals and objectives. We provide guidance at critical junctures in your personal and professional life. Specifically contribute to a traditional 401 k or IRA.

A Solo 401k for your business delivers major opportunities for huge tax deductions every year. Web Here are some of our favorite income tax reduction strategies for high earners. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Web The first way you can reduce your taxable income and therefore your tax on that income is. The contribution you will make.

High-income earners like senior executives who accumulate a large concentrated stock from their employer. The highest rate of 33 per cent. Web A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners.

Web Chen notes that the Income Tax Act in Canada requires that the spouse receiving the funds must keep the funds in the RRSP account for three years. For 2021 the IRS Solo 401k contribution limit is 58000 before eligibility for catch-up contributions. Understanding where you are income-wise matters when applying tax-saving strategies.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. However prior to the 2018 federal budget high earning individuals enjoyed two effective strategies to reduce their overall tax burden income splitting and reinvesting undistributed earnings from an active business into a private corporation. Ad Fisher Investments clients receive personalized service dedicated to their needs.

Web An overview of the tax rules for high-income earners. The loan is made at the CRAs prescribed interest rate.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Tax Planning For High Income Canadians Mnp

Tax Strategies For High Income Earners 2022 Youtube

Personal Income Tax Brackets Ontario 2021 Md Tax

Millionaires And High Income Earners Tax Foundation

Proposed Tax Changes For High Income Individuals Ey Us

Advanced Tax Strategies For High Net Worth Individuals Bnn Bloomberg

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

High Income Earners Need Specialized Advice Investment Executive

How Do Taxes Affect Income Inequality Tax Policy Center

How To Reduce Taxes For High Income Earners In Canada

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet